Parking Saga

In the fall of last year, an experiment was

started at the initiative of Moscow authorities:

from November 1, 2012 until February 28,

2013, parking on streets in Moscow’s center

became paid. The experiment was declared

successful by the city’s administration – while

calling for further perfection of technical matters

regarding payment. According to the new project,

starting on May 15, 2013, auto parking will

be payment-based across city territory within

the Boulevard Ring, as well as on certain parts

within the Garden Ring. Beginning in 2014,

parking could become payment-based within

the entire Garden Ring and in 2015 – within

the Third Transport Ring.

The citizenry, who initially spoke out against such actions by the city’s authorities, have

somehow reconciled with this thought, although experts on the commercial real estate

market believe that the introduction of paid parking could radically change the situation and

balance of forces both in the retail sphere and in the office real estate segment. And yet,

this hardly means a worsening. Simply everything will be a little… different.

FACTS AND NUMBERS

For starters – several numbers allowing for assessment of the “issue’s scale”. First: as

noted by first deputy director general at STA (State Treasury Agency) Sergei Marinichev,

the results of the research recently conducted by his agency evidence that 54% of

Moscow’s population recognize traffic as the city’s main problem. Second: inventorying

of Moscow’s parking space inside the TTR conducted again by Sergey Marinichev’s

agency shows that inside the CAD 46 thousand automobiles are standing in violation of

road traffic rules. Furthermore, in terms of the CAD’s overall parking capacity, this totals

303,000 auto spaces. And third: right now Moscow’s transport department is implementing

approximately 15 projects relating to the development of public transport.

Furthermore, a framework has been developed under which in the next several years

plans call for building approximately 35 thousand parking spaces in the center.

And now several numbers cited by representatives of the business community.

First: as noted by Evelina Ishmetova, vice-president of consulting department at GVA

Sawyer, presently in the Central business district (CBD), including the territory within

the Garden Ring and several neighboring business clusters (particularly Belorusskaya

district and Moscow-City territory), the calculation is the following: one parking space

per 100 sq.m of office space. Furthermore, up to 15 employees can work in 100

“squares”, while statistics say 60% of them have cars. Second: according to experts

from CBRE, located in the Central business district on territory of approximately

20 mln sq.m are more than 357 class A and B business centers, which altogether

offer their tenants approximately 33 thous parking spaces. Third: as highlighted by

Marina Novikova, analyst research at CBRE, according to the very lowest calculations,

10–15 thousand parking spaces are lacking inside the Garden Ring.

It must be noted at once – there’s no panic among the business community regarding

the Moscow government’s auto parking initiatives. Everyone realizes that the

center’s transport problem must be addressed, no matter how tempting it is to ignore.

Furthermore, as noted by Sergei Marinichev, the first experiment of November-February

showed that certain business segments will only benefit from the introduction of paid

parking. For example, the banks located in the area of the project pilot zone spoke

about it in the most exuberant tones: previously their clients arrived, searched for a parking

space for 30–40 minutes, and failing to find one left their car wherever they could

while risking incurring a fine, towing or other inconveniences. But while the experiment

was under way, there were 30–40% open spaces surrounding the bank branch and the

50–100 rubles spent while visiting the bank didn’t bother anyone.

Of course, it’s an entirely separate matter if we speak about visitors arriving for

30 minutes- one hour and office employees leaving their cars for the entire workday.

According to Evelina Ishmetova’s estimates, the lower threshold regarding rental rates

for parking spaces at high-caliber business centers inside the Central Business District

(CBD) is set at $400 per month (see Table 1). But under the program set forth by the

city, a minimum of $300 per month will be paid. A comparison of these numbers provides

the possibility to sketch several scenarios for the development of events once

the city’s administration introduces paid parking in the center. Furthermore, each one

of these scenarios has the following phrase as an epigraph: “Under no scenarios will

companies take on additional expenditures in order to provide their employees with

parking spaces (of course, this doesn’t pertain to top management)”.

First scenario: employees park in paid city garages for $300 a month. Second

scenario: employees independently agree with BC owners and park inside for some

amount of money. Third scenario: everyone who is able switches to public transport.

Fourth scenario: employees of center offices seek new places of employment in different

locations.

The last scenario can be undertaken not only by individual office employees, but also

entire companies. Which immediately engenders the question as to how much the city administration’s initiative will change the situation on the “central” office market. As

acknowledged by Evelina Ishmetova, at first GVA Sawyer thought that office moves

due to parking are no more than a myth. “But, digging into the situation”, they decided

that for certain companies this is indeed the reality. Ms. Ishmetova thinks that these

companies can actually be split into a small representative office in the center and back

office outside the TTR. Perhaps there will be few of these companies, but according

to her, even if 5% of the structures “get up and leave”, the share of vacant premises in

CBD centers will increase from today’s 7–8% to 15%. And if even 10% of premises

are vacated in office buildings, the IRR will start to fall considerably. However, CBRE

doesn’t believe in either isolated or en-masse departures of companies from the center.

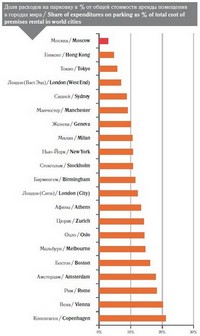

Above all because in Moscow the share of expenditures on parking in the overall total of

companies’ costs is relatively low, especially in comparison with world statistics.

Source: CBRE

Source: CBRE

And even if the owners of business centers eventually, under the pressure of mounting

numbers of drivers wishing to park their cars, increase the prices on their parking

spaces, this won’t prompt companies to move. However, of course, as noted by

Claudia Chistova, head of office research at CBRE in Russia, “according to the analysis

of office buildings inside the Garden Ring and parking spaces in these business centers,

we anticipate reduced demand for office premises bereft of parking along with

greater demand for office premises provided with an efficient parking factor. We also

believe that that the ban on free parking will serve as an additional stimulus for tenants

who have no need in terms of business and image to be in the city center to begin

exploring office premises outside the TRR”.

And finally, as told by Sergei Matyushin, his agency is developing a framework under

which the owners of buildings not provided with parking can reach out to the city’s

authorities with a request for either the organization of noncapital parking or the rental of

parking spaces from the city.

VIEW FROM BEHIND THE WINDOW

The experts assess the situation slightly differently when the conversation touches

upon the retail real estate segment. In terms of retail centers, in the majority of cases,

there was, remains and will be parking. The prices are by no means draconian, but

neither can they entice visitors to Neginnaya Plaza or Tsvetnoi to park underground.

And their outdoors parking interferes with traffic. For example, natural parking on the

Garden Ring, according to Dmitry Stepovoi, CEO of Atrium Mall, renders this part

of the Ring sclerotic. Furthermore, the underground parking at the mall itself is all

but empty. As a result, the owners of Atrium today propose setting up a fence along

the entire building facade facing the Ring. All the auto owners will be directed to

underground parking. However, the problem can be solved much easier. According

to the vast majority of experts, as soon as the new parking rules take effect the “carpeople”

themselves will rush towards the underground parking without any kind of

additional prompting.

And in the street retail segment, the introduction of paid parking could even be

welcomed. According to Irina Smirnova, Partner, Lead Consultant at MAGAZIN

MAGAZINOV, part of CBRE affiliate network, paid parking hardly hinders retail: “At a

more or less well-organized car park located under someone’s surveillance oftentimes

there’s even more order and more possibilities for finding space”. And yet what’s truly

pernicious for business is the lack of parking outside! “For example, the ban on parking

on Tverskaya, even though the street possesses high pedestrian traffic, led to downwards

adjustments of rates," Irina Smirnova emphasizes. It’s a separate matter that

over the past two years the experts note a considerable reduction of interest in street

retail properties on the part of, for example, tenants of the “clothing-footwear” segment.

Today these retailers prefer “retail centers” with guaranteed traffic. And their space outside

is occupied by restaurant businesses targeting “pedestrian” clients.

Автор: Oksana Samborskaya

CRE #7(205), April 2013